In our QQT (Quarterly Quick Take), we analyze the key signals and trends released in Caterpillar’s quarterly investor call and financial documents, indicating key trends around supply chain issues, production efficiency, price increases, cost headwinds and more.

SIGNALS, FROM INVESTOR CALLS

The Heavy mines investor calls for signals and trends that you care about. Below we cover a few of the most important signals, or you can review all signals here.

Want to review the full transcript for yourself? View full transcript from the call.

Focus of Discussion – High

These signals were “high” in terms of focus for the call, including executive prepared remarks and stock analyst questions.

- “Price” // 48 mentions – +17 mentions, or 54%, over previous quarter

- “Cost” // 39 mentions – (8) mentions, or 17% less than previous quarter

Select Notable Comments

The Heavy’s analysts look for key comments, indicating future actions and strategies. A few of those comments are noted below. View the call summary for all notable comments.

- “Geopolitical issues and local COVID policies are causing increased disruptions and significant cost increases in materials, logistics, freight, energy and labor.”

- “So, and I can say, this broadly across the globe, we haven’t seen any significant order cancellations as a result of the price actions that we’ve been taking.”

- “… hospital inventory almost a $40 million increase and that represents inventory that’s substantially complete awaiting one or two components that we can complete and ship”

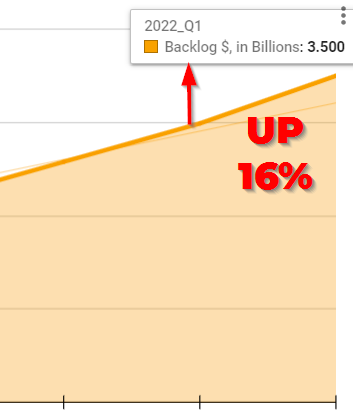

BACKLOG TRENDS AND INSIGHTS

In addition to mining the investor call, we dive deep into financial reports, with one focus on the backlog. The backlog, or the OEM’s list of unfulfilled orders for the next 12 months, is a critical metric to track due to it’s indication of health of the equipment market.

All following insights come from the Terex Backlog Tracker.

- The backlog continued to grow, now at $3 billion.

- Backlog year-over-year growth was $1.7 billion, or ~98%.

- Backlog quarter-over-quarter growth was $.5 billion, or ~17%.

- When comparing backlog growth to revenue growth, year-over-year, that ratio is 6.21, up from 4.70 in the previous quarter, indicating the backlog is growing faster than revenue (ability to meet market demand).

Want to compare Terex to other OEMS we cover? You can do that via our OEM Production Backlog Tracker. Here, you can compare backlog growth to revenue growth, a key indicator of an OEM’s ability to meet market demand.

Note – we update this date every quarter only after the final OEM’s data is released.

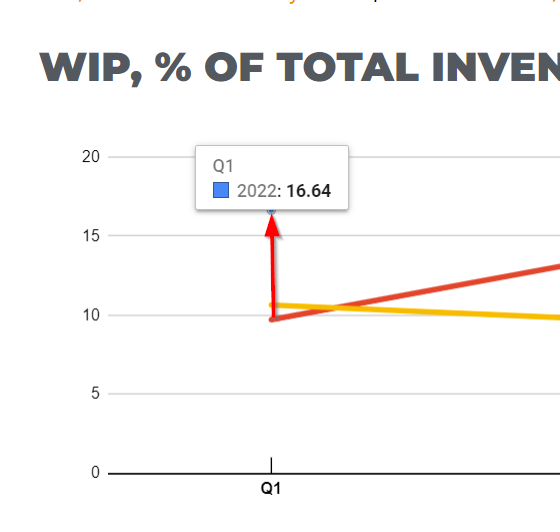

Inventory Trends and Insights

OEMs can’t deliver equipment if they don’t have them in inventory. In recent times, inventory has shifted from mostly “finished goods” to a growing % of “work-in-process”, as “hospital” assets cannot be completed and are pulled off the line, only to be finished when parts, like chips, are available – a sign of significant supply chain headwinds. Here are a few key insights from the Terex Inventory Tracker:

- WIP , as % of all inventory, increased from 13% to 16%

- Finished goods, as % of all inventory, decreased from 58% to 50%, yoy