It was quiet and surprising.

One day, in the middle of May, Caterpillar (CAT Financial, technically) rolled out an industry first incentive – a “Fuel Buyback” Program.

It’s ingenious. And a game changer.

Here’s why.

Caterpillar’s fuel buyback programs take standard incentive offer compensation – usually a cash rebate or discounted financing – and, instead, return that capital in the form of free fuel.

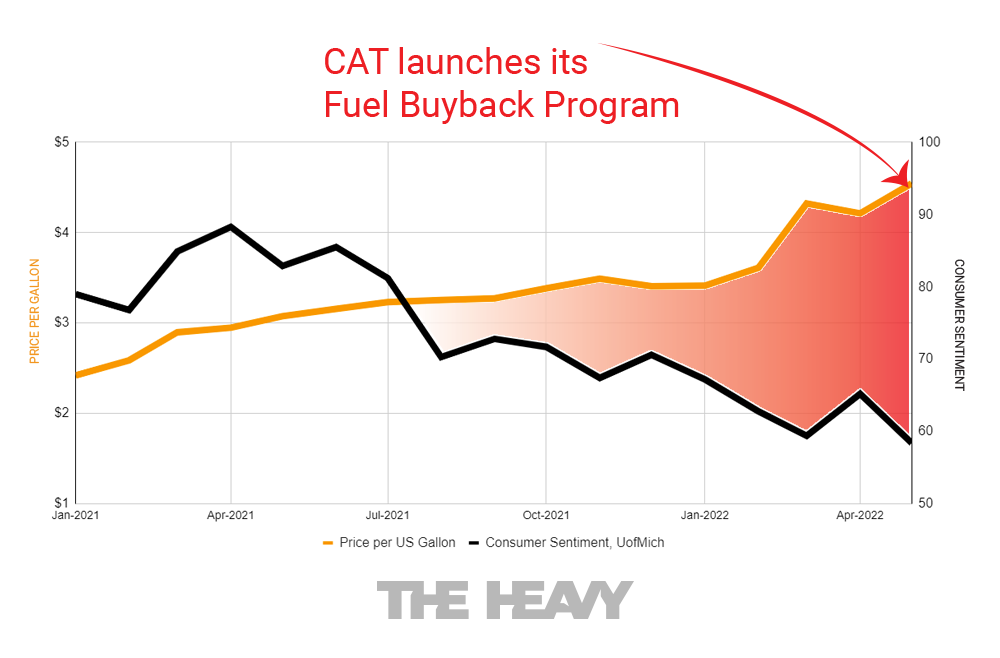

And their timing couldn’t be better. In May 2022, the difference between consumer sentiment and fuel prices is the highest it’s been in years, if not decades.

What’s included in the Caterpillar Fuel Buyback Program?

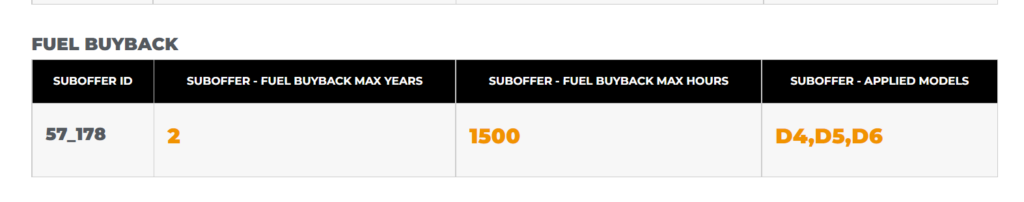

Using the free Incentive Database from The Heavy, let’s analyze their offering, as it applies to Dozers.

- The capital is returned to the customer in a form of an “account credit”

- Account credit is given until 1,500 or 24 months, whichever comes first

- It is packaged with a Cat “Customer Value Agreement”, which essentially a maintenace support plan.

Check out all CAT Financial fuel buyback programs.

Why is Caterpillar doing this?

At the end of the day, incentive offers are just creative ways of giving discounts / returning capital to customers. By packaging this capital in the form of free fuel, they’re creating an incentive offer unavailable anywhere else.

And it’s as much a marketing program as a financial one. As a unique offering, this offering can be promoted.

And CAT Financial’s excellent at marketing their incentives. Just check out what CAT’s doing with marketing their CVA.

How will other OEMs and financial organizations respond?

At this point, no other OEMs are offering fuel payback programs in any form. CAT Financial’s platform for delivering offers is sophisticated and searchable, fairly unique in the construction equipment market.

In terms of competition, we would most expect a competing, similar offer to come next from Deere and Case CE, as their incentive programs have similar search capabilities, and are often used as marketing vehicles.

It’s unlikely that other manufacturers will be able to match this kind of creative offering until their incentive platforms match the sophistication of CAT, which combines searchable features with a sophisticated marketing strategy.

Kudos, CAT Financial. Way to strike while the iron’s hot.